Battery Energy Storage Market Size Analysis

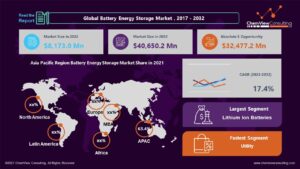

According to a research survey conducted by ChemView Consulting, in 2022, the Global Battery Energy Storage Market was worth US$ 8173.0 Mn and is expected to grow at a CAGR of 17.4% over the forecast period. While the historical CAGR is 15.6%, the market is expected to hit US$ 40,650.2 Mn by 2032 end.

Throughout the projected period, the market is anticipated to grow in response to rising demand for dependable and continuous power supply from end-use industries such as industrial, telecom, data centers, maritime, and medical.

Market Dynamic

FLUCTUATION IN THE POWER PRODUCTION B RENEWABLE SOURCES DRIVES THE MARKET FOR BATTERY ENERGY STORAGE

Solar and wind energy are the most common renewable energy sources stored in networks. However, the energy production process fluctuations result from the sun being blocked by clouds or shifting wind currents. Due to these variations, flexible grid systems that store energy are necessary. The grid modernization process is increasingly dependent on battery energy storage devices.

When the amount of power generated exceeds the amount of electricity needed, these solutions assist grid operators in saving electricity. About the generation, transmission, and distribution of electric power, these systems enhance the dependability and flexibility of energy supply systems.

HIGH INVESTMENT COSTS HAMPER THE MARKET GROWTH

Due to their high energy density and enhanced performance, battery energy storage technologies, including lithium-ion, flow, and lead-acid batteries, all demand higher installation expenses. Due to its high energy density, low rate of self-discharge, and low maintenance needs, lithium-ion batteries are expensive.

However, it is anticipated that lithium-ion battery prices will decrease. These batteries have a huge capacity and are lightweight and small, making them suitable for use in electric vehicles (EVs). A significant barrier to the market’s expansion may be the high initial investment costs necessary to produce flow batteries.

THE RISE IN ELECTRIFICATION PROJECTS WILL CREATE MORE OPPORTUNITIES FOR THE MARKET

In the upcoming years, there are expected to be a lot of opportunities for the adoption of battery energy storage systems due to the worldwide increase in rural electrification projects, the rise in demand for continuous power supply brought on by the growth in the number of data centers, and the falling cost of lithium-ion batteries.

COVID-19 Impact

The abrupt coronavirus outbreak has had a negative impact on the expansion of utility applications. In several projects, the installation of battery energy storage systems was declining in 2021. Additionally, the worldwide closure of production facilities in 2020’s first and second quarters is to blame for slowing the market’s expansion.

However, it is anticipated that the adoption of batteries and, therefore, the battery energy storage systems will expand due to the growing installation of battery energy storage systems in operational projects and the growing government focus on upgrading the electricity sector. The market value might not catch up to the pre-COVID-19 value until 2027.

Market Segments Covered in Report

By Storage System:

- Front-of-the-meter

- Behind-the-meter

By Element:

- Battery

- Others

By Battery Type :

- Lithium-Ion Batteries

- Advanced Lead-Acid Batteries

- Flow Batteries

- Others

By Connection Type:

- On-grid

- Off-grid

By Ownership:

- Customer-Owned

- Third-Party Owned

- Utility-Owned

By Energy Capacity:

- Below 100 MWh

- Between 100 to 500 MWh

- Above 500 MWh

By Application:

- Residential

- Commercial

- Utility

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Segment-Wise Analysis

Why are lithium-ion batteries projected to ensure the most revenue during the forecast period?

At 55.0% of the market, lithium-ion batteries had the greatest revenue share. Due to its lightweight, low cost, and restricted coverage area, lithium-ion batteries are expected to increase demand for energy storage systems. The lithium-ion battery energy storage systems market will also rise due to increasing infrastructure investment from the residential, industrial, and commercial sectors.

Why is the utility segment expected to expand the fastest during the forecast period?

In 2021, the utility application market will rule. The primary driver of the expansion of the utility sector is the necessity to meet peak power consumption. In the event of an abrupt change in the energy supply, the utility BESS offers control services for power quality, frequency, and voltage.

When there is an excess of renewable energy, grid operators can reduce their power use thanks to battery energy storage devices. The increased demand for battery energy storage systems in the utility industry is caused by the growing need for renewable energy and the increasing requirement for a consistent and efficient power supply in most locations.

Region-Wise Analysis

The regions analyzed for the market include North America, Europe, Latin America, Asia Pacific, Middle East, and Africa.

- In 2021, the Asia Pacific market held a sizeable revenue share of 4.0%. In emerging economies, rapid population development has raised the need for electricity. Over the next seven years, grid operators will increase flexibility and reduce power disruptions by installing battery energy storage devices.

- The U.S. is the main driver of regional growth in North America, which has the second-largest proportion of the battery energy storage systems market. Energy storage has become a key component of all energy planning in the United States due to the expansion of utilities and businesses. Industry leaders place a high priority on the security of these energy storage systems.

Competition Analysis

Major corporations are utilizing organic and inorganic development tactics to strengthen their position in the market by diversifying the products they provide.

Some of the key developments that have taken place in the Battery Energy Storage Market include:

- In December 2021, The PRiMX battery brand was introduced by SAMSUNG SDI Co., Ltd. It offers consumers quality, performance, and a proven advantage, which translates to user ease thanks to the company’s exclusive technology. The brand has trademark protection in Korea and Europe and will shortly get US registration.

- In June 2020, Panasonic and Span.IO, Inc. (US) recently inked a new contract to construct a home energy storage system. This technology will probably be added to Panasonic’s EverVolt, along with the Span smart panel, giving users of the EverVolt a new degree of control over their battery backup power and simple energy management for their homes.

A list of some of the key suppliers present in the market are:

- BYD Company Limited

- General Electric

- Hitachi, Ltd.

- Honeywell Corporation

- LG Energy Solutions CO., Ltd.

- Panasonic Corporation

- SAMSUNG SDI Co., Ltd.

- Siemens AG

- Tesla, Inc.

- Toshiba Corporation

- ABB

Report Coverage and Highlights

- Our comprehensive, data-backed, and facts-oriented report provides niche and cross-sectional analysis at global and country levels.

- Assessment of the historical (actual data) and current market size (2017-2021), market projections (2022-2032), and CAGR.

- The market assessment across North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East, and Africa.

- Competitive tactical intelligence, key strategies adopted by top players, production capacity and company shares analysis, product brand surveys, and export-import analysis

- Pricing analysis to set and benchmark your current or future offerings across each product type helps you understand whether your pricing strategy is aligned with market expectations and can be compared to market disruptions.

- Predictions on critical supply and demand trends and technological expertise needed to address operations scalability.

- Consumer behavior shifts and their implications for players, list of end-users, and their consumption analysis.

- Key drivers, restraints, opportunities, and emerging trends impacting the market growth.

- Value chain analysis (list of manufacturers, distributors, end-users, and average profitability margins).

- Strategic market analysis, recommendations, and future headways on crucial winning strategies.

| Research Scope | Details |

| Forecast period | 2022-2032 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Tons for Volume, and CAGR from 2022 to 2032 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Storage System, Element, Battery Type, Connection Type, Ownership, Energy Capacity, Application, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |