Global Carboxymethyl Cellulose Market Size Analysis

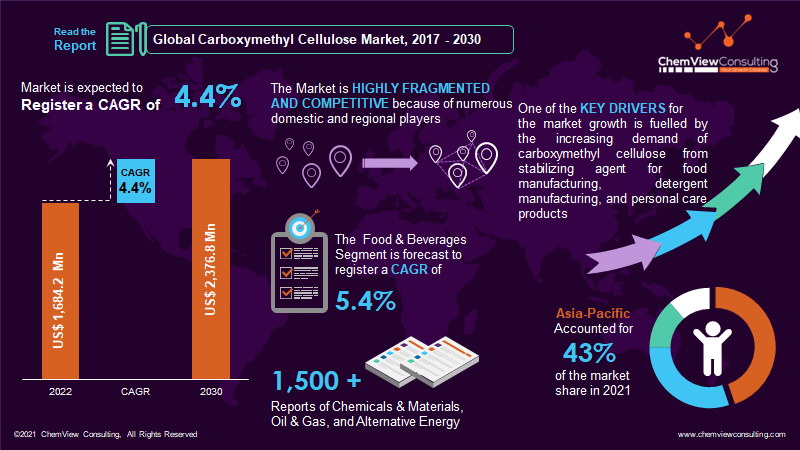

According to a research analysis conducted by ChemView Consulting, in 2022, the Global Carboxymethyl Cellulose Market was worth US$ 1,684.2 Mn, and it is expected to grow at a CAGR of 4.4% over the forecast period. The market is expected to hit US$ 2,376.8 Mn by 2030 end.

Market Dynamics

- Rise in Ready-to-Eat Food: Concerns about food availability and safety during the pandemic resulted in massive demand for food like primary foodstuffs, convenience, and secondary processed foods. This aspect boosted demand for food stabilizers, thickening agents, and other food-processing components, propelling the market even higher.

- 3D Bio-printability of Carboxymethyl Cellulose-based Hydrogel: North Dakota State University researchers from the Pharmaceutical Sciences Department and the Industrial and Manufacturing Engineering Department created a novel hybrid hydrogel – sodium alginate integrated with carboxymethyl cellulose – that has demonstrated high effectiveness in 3D bio-printing applications. This hybrid hydrogel is a potential biomaterial for 3D bio-printing processes for large-scale fabrication of functional tissue scaffolds.

- Health-Conscious in Millennials: Because CMC is a fat substitute, it’s commonly used in gluten-free and low-fat meals. The demand for gluten-free and fat-free food items is increasing as people become more aware of the possible detrimental consequences of gluten and fat intake. This cause is driving the demand for carboxymethyl cellulose.

- Greater use in Laundry: The sodium derivative of carboxymethyl cellulose is widely used in detergent production due to its excellent anti-soil redepositing properties. It also acts as a particle suspender, color retention agent, homogenizer, stabilizer, and skin and texture protector in detergents.

Segment-Wise Analysis

Why does the Cosmetics & Personal Care segment hold the highest market share in the Carboxymethyl Cellulose Market?

In the carboxymethyl cellulose industry, personal care items and cosmetics offer producers value-grab possibilities. The segment is projected to grow at a CAGR of 5.3% between 2022-3030.

CMC is becoming more popular because of hair care products, hair grooming aids, and shampoos. The need for carboxymethyl cellulose is fueled by cosmetic moisturizing skin care products, creams, and lotions. Cold creams, hand skin care preparations, and cosmetics foundations are among the products that manufacturers are ramping up production. Eyeshadow blushers and eyeliners spark the demand for CMC.

For producers in the carboxymethyl cellulose sector, toothpaste formulas provide dependable revenue streams. The need for carboxymethyl cellulose is being fueled by regular white, clear translucent gels and tartar control toothpaste. This helps to explain why the industry is expected to reach US$ 1.75 billion by 2030.

Which application type is expected to dominate the Carboxymethyl Cellulose Market?

The application category’s food and beverage segment are estimated to hold a market size of US$ 575.9 Mn in 2021. This segment is expected to grow at a stellar 5.4% value CAGR during the forecast period. In terms of volume, the food and beverage segment leads the pack, with a high number of units produced each year.

Demand for packaged foods, instant noodles, ready-to-cook, and gluten-free foods is expected to rise. Furthermore, the rising demand for detergents due to the exceptional properties of sodium carboxymethyl cellulose will drive market growth. Another growing segment is using CMC in oil drilling activities as a thickening agent for water retention in drilling mud.

Why does Asia-Pacific account for the largest market share in the Carboxymethyl Cellulose Market?

In 2021, the Asia Pacific market was worth US$ 692.5 Mn. The growing demand for convenience, secondary and tertiary processed foods ascribed to the population in nations like China, India, Malaysia, Indonesia, Bangladesh, and others is likely to propel regional growth.

Growing demand for personal care products in emerging economies due to rising disposable income and changing lifestyles, particularly in India, China, Malaysia, and Indonesia, is expected to drive industry growth by the end of 2030.

How is North America Faring in the Carboxymethyl Cellulose Market?

North America is one of the largest oil drilling regions. The presence of a large manufacturing base for oil drilling fluids attributed to huge oil reserves is expected to boost the demand for carboxymethyl cellulose, an important thickening additive used on oilfield chemicals. Furthermore, increasing awareness among consumers regarding the health benefits of gluten-free products is fostering the demand for food-grade CMC.

Also, commercial buyers in developed economies prefer equipment with advanced diagnosis and automation. Manufacturers have significantly improved their response time to such client custom requirements through research, development, and product innovation in carboxymethyl cellulose products and goods.

Competition Analysis

Because of numerous domestic and regional players, the global carboxymethyl cellulose market is highly fragmented and competitive.

To remain competitive in the industry, key market players are investing in expanding their market footprint. Several vital players invest a fair share of their revenue in research and development to boost their product portfolio. Market participants focus on technological development and utilizing a product in several applications.

Some Key Developments:

- In 2021, Ashland Global Holdings Inc. acquired Schulke & Mayr GmbH’s personal care business. This acquisition will help to strengthen the company’s consumer business portfolio and expand its biotechnology and microbiology technical competencies.

- In 2020, Nouryon completed its acquisition of the CMC business from J.M Huber Corporation, accelerating long-term growth in the regional market.

- In 2019, Nippon Paper, a global manufacturer of cellulose and paper products, announced the construction of a new manufacturing facility at the Gotsu Mill to produce carboxymethyl cellulose, a functional cellulose product.

A list of some of the key suppliers present in the market are:

- CP Kelco U.S., Inc

- Nippon Paper Industries Co. Ltd

- Ashland Inc.

- Dow Chemical Company

- Lamberti S.P.A

- DKS Co. Ltd

- Química Amtex S.A.

- Nouryon

- Anqiu Eagle Cellulose Co., Ltd

- Wealthy Chemical Industry (Suzhou) Co., Ltd.

- Shanghai Shenguang Edible Chemicals Co., Ltd.

- Akzo Nobel N.V.

- Xuzhou Liyuan cellulose Technology Co. Ltd.

- Daicel Finechem Ltd

- Mikro Technik GmbH

- Patel Industries

Market Segments Covered in Report

By Purity Level:

- Highly Purified

- Technical Grade

- Industrial Grade

By Application:

- Food & Beverages

- Oil & refining

- Pharmaceutical

- Paint & Textile

- Cosmetics & Personal Care

- Paper Coating & Household Care

- Others

By Property:

- Thickening Agent

- Stabilizer

- Binder

- Anti-repository Agent

- Lubricator

- Emulsifier

- Excipient

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Global Carboxymethyl Cellulose Market 2022-2030: Report Coverage and Highlights

- Assessment of the historical and current market size (2017-2021), market projections (2022-2030), and its contribution to the parent market

- Key drivers, restraints, opportunities, and key emerging trends impacting market growth

- Predictions on critical supply, demand, and technological trends and changes in consumer behavior

- Value chain analysis (list of manufacturers, distributors, end-users, average profitability margins, etc.)

- Segment-wise, country-wise, and region-wise market analysis

- Competition mapping, market share analysis, key strategies adopted by top players, and competitive tactical intelligence

- Key product innovations and regulatory framework

- Covid-19 impact on the market and how to navigate

- Strategic market analysis and recommendations on crucial winning strategies

| Research Scope | Details |

| Forecast period | 2022-2030 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | Purity, Application, Property, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |