Chemical Testing Services Market Size Analysis

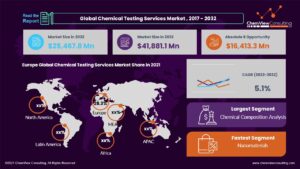

According to a recent survey conducted by ChemView Consulting, the Global Chemical Testing Services Market grew at a CAGR of 4.2% between 2017-2021 and is estimated to be US$ 25,467.8Mn in 2022. Currently, the market is anticipated to grow at a CAGR of 5.1% and is expected to reach a valuation of US$ 41,881.1Mn by 2032 end.

Various macroeconomic and industrial factors, such as the expansion of the chemical industry, the rise of manufacturing sectors, the growth of the mining industry, economic growth, and developments in nanotechnology, have impacted the market. In the upcoming years, it is anticipated that these industrial factors will substantially affect market growth for chemical testing services.

Market Dynamic

RISING EXPORT OF FOOD & BEVERAGES SPURRING DEMAND FOR CHEMICAL TESTING SERVICES

Governments from different nations continuously work to boost quality through various food safety regulations and improve the export quality of chemical testing and certification of consumer items. One of the major producers of food exports worldwide in Latin America.

Fresh fruits, acai berries, salmon, coffee, and other foods are among the food items from Latin America that are most frequently sent to the United States. Latin America is thus concentrating on implementing new chemical testing rules and inspection criteria for food items to meet international food standards and increase its growth prospects.

RAPIDLY CHANGING TESTING REQUIREMENTS GLOBALLY

Companies are introducing and patenting an increasing number of new compounds and launching several new chemical products that call for rigorous testing. As a result, the technology employed by various chemical testing service providers must routinely adapt to the constantly shifting requirements and fulfill testing requirements on time.

Additionally, the pandemic saw a sharp increase in testing needs in the pharmaceutical industry, largely due to various businesses’ introduction of several medical items. Chemical testing services were under intense pressure. As a result, examine and approve as many items as possible in a short time. Therefore, a major challenge facing the chemical testing industry is dealing with rapidly changing testing requirements.

ONGOING INNOVATIONS BY WASTE MANAGEMENT COMPANIES

Growth in the next ten years is anticipated to be driven by a rise in small- and medium-sized businesses involved in the global market for chemical testing services. This is primarily due to continual service advancements provided by various trash management businesses in the industry.

By providing their services in rural areas, major companies in the market for chemical testing services are concentrating on increasing their market share globally. Chemical testing service companies are attempting to draw clients from rural areas to compete with their rivals. Additionally, with a growing emphasis on separating food waste from various sources, including industrial, commercial, and residential, leading players in the chemical testing services market is poised to benefit from new growth prospects in the following decade.

Market Segments Covered in Report

By Testing Service:

- Chemical Composition Analysis

- Chemical Trace Analysis

- Chemicals Regulatory Compliance Testing

- Contamination Detection and Analysis

- Material Testing and Analysis

- Elemental Analysis Certification

- Others

By Sample Type:

- Agrochemicals & Pesticides

- Basic & Industrial Chemicals

- Dyes & Detergents

- Lubricants & Greases

- Nanomaterial

- Petrochemicals

- Polymers & Plastics

- Specialty Chemicals

By End-Use:

- Consumers Goods

- Environmental

- Manufacturing

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Segment-Wise Analysis

Which is the most preferred type of chemical testing service?

The Chemical Composition Analysis segment is anticipated to experience a CAGR of 7.4% over the projected period by service type. Basic and industrial chemicals are essential ingredients for producing goods utilized by both industry and end users, and they are typically obtained in huge amounts.

They largely consist of chemical raw materials made from petrochemicals, basic inorganics, and intermediates used in chemical testing service processes, which raises the need for testing for chemical regulatory compliance in the global market for chemical testing services. The consumer products, environmental initiatives, and manufacturing industries use the Chemical Composition Analysis segment, mostly for auditing, inspection, testing, analysis, and certification procedures.

Who is the leading end user in the chemical testing services industry?

In the future ten years, the consumer goods sector is anticipated to account for around two-thirds of the global market for chemical testing services by end-use. The demand for chemical testing services for consumer goods is expected to rise as the cosmetics, packaging, paper, detergents, food, beverage, and automotive industries expand globally. These services are now being used in the consumer goods sector because important players receive funding or discounts from public or private organizations.

Chemical testing and analyzing technologies related to chemical trace analysis and nanotechnologies have undergone constant improvement due to the consumer goods industry’s quick transition to safe products free of dangerous chemicals.

Region-Wise Analysis

The regions analyzed for the market include North America, Europe, Latin America, Asia Pacific, Middle East, and Africa.

- Regarding market share for chemical testing services, the European area remained in the top spot with 28.3%. Regulations like the Restriction of Hazardous Substances (RoHS) directive and the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) program, which enforces chemical regulations domestically and internationally, are particularly responsible for the rise in the demand for chemical testing in Europe.

- The United States currently receives services for both internal testing and external testing (outsourcing) from major players across North America. In the age of industrialization and high consumer awareness, many businesses face challenges brought on by the complexity of their operations, raising supply chain risks to previously unheard-of levels.

Competition Analysis

Key players in the market for chemical testing services are engaging in merger and acquisition activities to diversify their clientele and expand into untapped markets & industries. Due to the quick technological change in various sectors and the ongoing development of these industries, key market participants are also concentrating on launching new services and innovating their current testing procedures.

The key developments in the Global Chemical Testing Services Market:

- In September 2022, the leading provider of inspection and testing services, Element Materials Technology, completed the purchase of National Technical Systems (NTS) and obtained all necessary regulatory permissions.

- In September 2022, Agilex Biolabs increased its capacity by developing a new toxicology facility in Australia with more than 10,000 square feet of lab space. It would enable the business to provide greater services to the worldwide pharmaceutical, biotech, and animal health industries.

A list of some of the key suppliers present in the market are:

- Intertek Group Plc

- Bureau Veritas

- SGS SA

- TÜV NORD AG

- UL LLC

- SAI Global Limited

- Aspirata Auditing Testing And Certification (Pty) Ltd

- SCS Global Services

- TÜV Rheinland Group

- MISTRAS Group

- AsureQuality Limited

- Nippon Kaiji Kentei Kyokai

- Dekra SE

- Lloyd’s Register Group Services Limited

- Indocert

Report Coverage and Highlights

- Our comprehensive, data-backed, and facts-oriented report provides niche and cross-sectional analysis at global and country levels.

- Assessment of the historical (actual data) and current market size (2017-2021), market projections (2022-2032), and CAGR.

- The market assessment across North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East, and Africa.

- Competitive tactical intelligence, key strategies adopted by top players, production capacity and company shares analysis, product brand surveys, and export-import analysis

- Pricing analysis to set and benchmark your current or future offerings across each product type helps you understand whether your pricing strategy is aligned with market expectations and can be compared to market disruptions.

- Predictions on critical supply and demand trends and technological expertise needed to address operations scalability.

- Consumer behavior shifts and their implications for players, list of end-users, and their consumption analysis.

- Key drivers, restraints, opportunities, and emerging trends impacting the market growth.

- Value chain analysis (list of manufacturers, distributors, end-users, and average profitability margins).

- Strategic market analysis, recommendations, and future headways on crucial winning strategies.

| Research Scope | Details |

| Forecast period | 2022-2032 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Tons for Volume, and CAGR from 2022 to 2032 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Testing Service, Sample Type, End-Use, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |