Fatty Amines Market Size Analysis

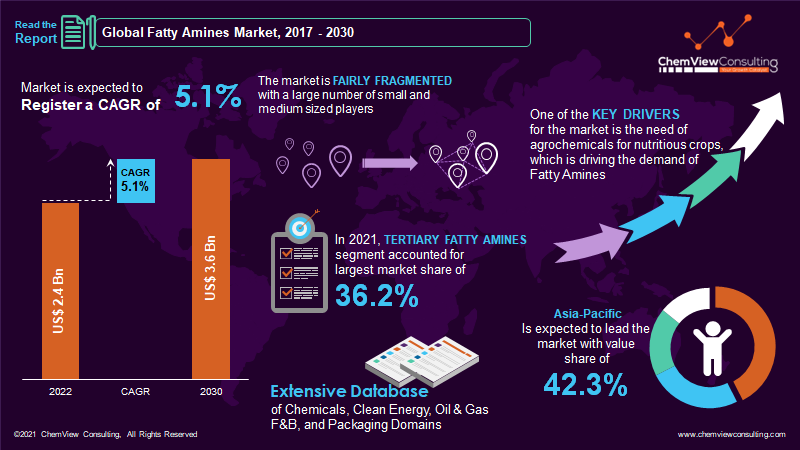

According to a research survey conducted by ChemView Consulting, in 2022, the Global Fatty Amines Market was worth US$ 2.4 Bn and is expected to grow at a CAGR of 5.1% over the forecast period. The market is expected to hit US$ 3.6 Bn by 2030 end.

Fatty amines are nitrogen byproducts of olefins, alcohols, or unsaturated fats derived from natural sources, unrefined petrochemical materials, and fats and oils.

| Market Size in 2022 | US$ 2.4 Bn |

| Market Size in 2030 | US$ 3.6 Bn |

| CAGR (2022-2030) | 5.1% |

| Largest Region Market Share | 42.3% (Asia-Pacific) |

| Largest Segment Market Share, By Product Type (2021) | 36.2% (Tertiary Fatty Amines) |

| Top 5 Companies Consolidated Share | 55-60% |

| Fastest Growing Segment CAGR, By End-Use (2022-2030) | 5.9% |

Market Dynamic

What are the causes driving the rise in demand for Fatty Amines?

Rising demand for liquid detergent and fabric softeners, as well as increased industrial investment in developed nations, are likely to drive market expansion. Furthermore, low raw material costs and abundant availability, combined with low toxicity levels and production costs, are expected to provide profitable growth prospects during the forecast period.

The derivatives and products are used to do cleaning, emulsifying, scouring, and as wetting agents for products such as personal care, home care, and lubricants, increasing product demand.

What are the opportunities in the Fatty Amines business?

The increased need for agrochemicals in agriculture propels the Fatty Amines market forward. Factors such as changing additives technology, low VOC (Volatile Organic Compound), and other legislation are expected to increase demand for bio-based, environmentally friendly additives in the paints and coatings industry. Thereby growing demand for Fatty Amines and providing an opportunity for global growth of the Fatty Amines market.

Government-led economic diversification activities are also projected to boost the overall market growth.

Segment-Wise Analysis

Which segment has the biggest market share for Fatty Amines?

Tertiary Fatty Amines are expected to grow at the fastest CAGR in value and volume over the forecast period. Tertiary Fatty Amines and their derivatives, such as quaternary ammonium compounds, are used in various applications, including fabric softeners, surfactants, drilling muds, asphalt emulsifiers, and disinfectants/bactericides. The wide-range uses of tertiary Amines are primarily responsible for the market’s growth.

By the end of 2031, the Tertiary Fatty Amines segment is predicted to control about 45.0% market in terms of product type.

Which End-Use industry is expected to grow the most?

The Agrochemicals segment will lead the Fatty Amines market during the forecast year. The increase in the global need for nutritious and high-quality food, combined with the restricted quantity of arable land, is driving the demand for agrochemicals. These factors fuel the demand for the end-use segment of the Fatty Amines market’s agrochemicals.

Why is the Asia-Pacific region cementing its global dominance in the Fatty Amines Market?

The Asia Pacific region is expected to lead the Fatty Amines market with market share of 42.3% in 2021. The need for Fatty Amines is expanding in Asia as governments in nations such as China, Japan, and Thailand place a greater emphasis on wastewater treatment infrastructure.

Furthermore, the increased need for personal care and beauty goods is expected to drive the demand for Fatty Amines. The demand for Tertiary Fatty Amines has been increasing in Asia, accounting for most of its diverse applications and adaptability.

With increased pressure on the Asia Pacific agriculture sector, the market in this area is expected to maintain its financial dominance and volume.

Competition Analysis

Major market players have used expansions, acquisitions, divestments, collaborations, and joint ventures to strengthen their market position.

Several biggest corporations invest in R&D operations to achieve a competitive advantage. Suppliers use product development techniques and positioning to reach a market presence. Manufacturers are collaborating with major end customers to deliver tailored Fatty Amines products. Companies worldwide are increasingly focusing on research efforts. Thus growth is on the horizon.

A list of some of the critical suppliers present in the market are:

- Akzo Nobel N.V.

- Evonik Industries AG

- Kao Corporation

- Clariant AG

- Arkema S.A

- Solvay S.A

- I. du Pont de Nemours & Co

- Albemarle Corporation

- Procter & Gamble Company

- Lonza Group Ltd

- Indian Glycols Ltd.

- Indo Amines

- Qida Chemical Co.

- Shandong Dafeng Biotechnology Co.

- Temix International S.R.L.

- Global Amines Company Pte. Ltd.

- Huntsman International LLC

- Volant-Chem Group

- KLK OLEO

- Indo Amines Ltd.

- Ecogreen Oleochemicals GmbH

- Kao Corporation

Market Segments Covered in Report

By Product Type:

- Primary Amines

- Secondary Amines

- Tertiary Amines

By End-Use:

- Agrochemicals

- Oilfield Chemicals

- Asphalt additives

- Anti-Caking

- Water treatment

- Chemical Synthesis

- Personal Care

- Household

- Others

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Global Fatty Amines Market 2022-2030: Report Coverage and Highlights

- Assessment of the historical and current market size (2017-2021), market projections (2022-2030), and its contribution to the parent market

- Key drivers, restraints, opportunities, and key emerging trends impacting market growth

- Predictions on critical supply, demand, and technological trends and changes in consumer behavior

- Value chain analysis (list of manufacturers, distributors, end-users, average profitability margins, etc.)

- Segment-wise, country-wise, and region-wise market analysis

- Competition mapping, market share analysis, key strategies adopted by top players, and competitive tactical intelligence

- Key product innovations and regulatory framework

- Covid-19 impact on the market and how to navigate

- Strategic market analysis and recommendations on crucial winning strategies

| Research Scope | Details |

| Forecast period | 2022-2030 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Billion for Value and Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Product Type, End-Use, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |