Isoprene Rubber Latex Market Size Analysis

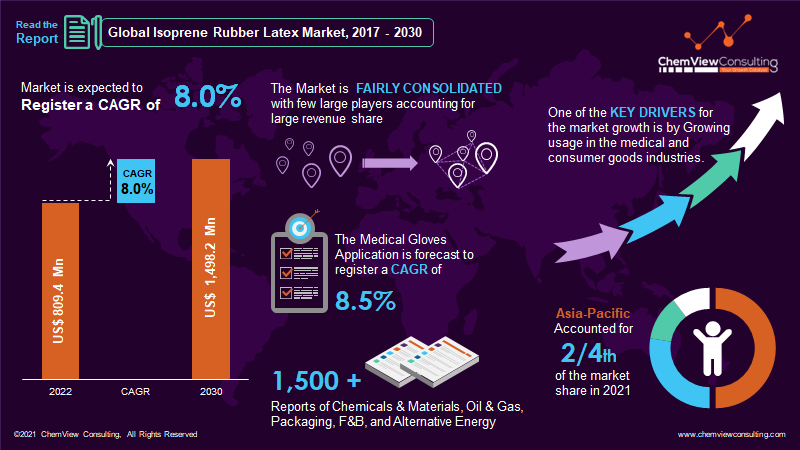

According to a research analysis conducted by ChemView Consulting, The global Isoprene Rubber latex market size was valued at US$ 809.4 Mn in 2022 and is projected to reach US$ 1498.2 Mn by 2030, with a CAGR of 8.0% from 2022 to 2030.

Growing demand from the medical, consumer products, and industrial sectors is expected to propel the isoprene rubber latex business forward. worldwide

Furthermore, The Market for isoprene rubber latex accounts for around 25% of the worldwide isoprene market. Isoprene is utilized in various sectors, including the automotive, medical, and construction industries. The isoprene market is expected to be driven by the growing use of synthetic rubber in these sectors.

Market Dynamics

What are the key drivers bolstering the growth of the Isoprene Rubber latex market?

Rising Demand for Medical Equipment from Healthcare Industry is bolstering the Market

Medical gloves account for more than half of the value share in the global Market of isoprene rubber latex. Manufacturers of isoprene rubber latex are finding major applications in medical balloons and catheters and surgical globes. The growing applicability is mostly due to increased patient safety, this is also boosting the usage of isoprene rubber latex as a replacement for conventional rubber in the production of medical safety equipment.

Surgical gloves are more often manufactured from natural rubber latex; owing to increasing concern for patient safety, several hospitals prefer alternative natural rubber materials that include polychloroprene and polyisoprene to ensure the safety of patients from allergies.

Growth in the Construction Sector to Fuel the Growth of Isoprene Rubber Latex Demand

Governments all around the globe is investing significantly in the construction and infrastructure sector to enhance the inter connectedness in a country to boost the country’s development along with maintaining the economic growth. Rising construction activities is expected to increase the demand for adhesives and sealants, which are manufactured with isoprene rubber latex.

The governments are emphasizing on safety of construction workers by providing them with PPE kit like safety gloves, helmets, shoes and other items, which is also fueling the demand of isoprene rubber latex in the construction industry.

The protective gloves demand is increasing as workers became more aware of safety and occupational heath hazards in the construction sector. The majority of the workers who work with sharp edged materials such as, metal, glass have seen a boost in the product usage.

What are the opportunities in the Isoprene Rubber latex Market?

Robust industrial growth to drive adoption of Industrial Gloves and Adhesives

The global isoprene rubber latex market in the emerging nations is expected to be driven by FDI flows for the industrial sector, including manufacturing, construction and healthcare. According to the statistics of MOSPI, in India, the industrial sector’s contribution to the GDP is around 26% in 2021.

With the flourishing industrial sector, which includes construction, manufacturing, mining utilities, oil & gas, demand for personal protective equipment including industrial gloves in the developing countries is expected to witness a significant growth over the projected period. Owing to these factors several companies are entering into the Market of Asia Pacific to capitalize on the surging demand and expand their geographical footprint.

For this, the companies are focusing closely on developing the products that comply with the safety norms of the local markets. Mnus with the investment in the production of gloves in developing nations, demand for isoprene rubber latex is also expected to increase in the coming years.

Segment-Wise Analysis

How is the medical sector supporting the growth of the isoprene rubber latex market?

Medical gloves account for more than half of the market value of isoprene rubber latex. The growing manufacture of medical balloons and catheters will boost demand for isoprene rubber latex.

The Market’s overall development will be aided by a greater focus on patient safety and a global increase in understanding alternatives to traditional rubber materials used to manufacture different medical devices.

The medical industry’s need for surgical gloves is steadily expanding. In addition, the need for appropriate material for surgical glove manufacture would provide a favorable atmosphere for the expansion of the isoprene rubber latex market. Cariflex (Isoprene rubber latex) is an excellent alternative for natural rubber latex in dipped items.

Why is demand for isoprene rubber latex increasing in the United States?

The Market for isoprene rubber latex in the United States expanded 5.5% year over year in 2021, reaching a value of US$ 137.7 Mn. In the future years, the rapid development of end-use sectors in the United States, such as medical, construction, and industrial safety equipment, is predicted to enhance demand for isoprene rubber latex for manufacturing safety gloves.

One of the significant causes driving demand for isoprene rubber latex in the United States is the growing need for medical and industrial gloves, notably in the industrial and healthcare sectors. The rising usage of isoprene rubber latex in manufacturing personal protective equipment and industrial goods like seals, gaskets, and conveyor belts will continue to be a significant development driver.

Why Asia-Pacific is faring in the global isoprene rubber latex market?

In 2021, Asia-Pacific region is estimated to account for more than two-fourths of the global volume share, which is higher than any other region. In 2021, the China Isoprene Rubber Latex market was valued at US$ 115.9 Mn growing at a CAGR of 7.1% between 2022 and 2030.

The primary factors driving demand for medical gloves are the adoption of higher healthcare standards and increased awareness about personal safety and hygiene.

Aside from that, China’s emphasis on population control and raising awareness about the prevention of sexually transmitted diseases has resulted in high condom demand. This has created a favorable environment for the country’s sale of isoprene rubber latex.

Competition Analysis

Isoprene rubber latex market is estimated to be a fairly consolidated market with top players dominating over the business with a significant share.

To remain competitive in the industry, key market players are investing in expanding their market footprint. Several vital players invest a fair share of their revenue in research and development to boost their product portfolio. Market participants focus on technological development and utilizing a product in several applications.

Some of the key developments that have taken place in the isoprene rubber latex market include:

- In January 2021, Ansell Limited completed the acquisition of the Primus brand and related assets that constitute the Life Science business belonging to Primus Gloves and Sanrea Healthcare Products. In addition, Ansell and Primus have entered into a long-term supply partnership.

- In April 2018, Top Glove Corp Bhd, a Malaysian rubber glove company, announced the acquisition of Aspion Sdn Bhd, one of the world’s top surgical glove manufacturers. The purchase will help the firm expand its manufacturing capacity and solidify its position as its largest glove producer.

A list of some of the key players present in the Market are:

- Ansell Limited

- Hexion Inc.

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd

- Top Glove Corporation Bhd

- Kraton Corporation

- Zeon Corporation

- Kent Elastomer Products Inc.

- Kuraray Co., Ltd.

- Puyang Linshi Chemical & New Material Co., Ltd.

- PAO Sibur Holdings

- JSR Corporation

- Supermax Corp. Bhd

- Royal Dutch Shell Plc

- Rubberex Corporation

Segments Covered in Report

By Application:

- Medical Gloves

- Condoms

- Medical Balloon

- Catheters

- Adhesives

By End Use:

- Medical

- Consumer Goods

- Industrial

By Source:

- Natural

- Synthetic

- 1,3 – Butadiene

- 2-methyl-1,3-butadiene

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Global isoprene rubber latex Market 2022-2030: Report Coverage and Highlights

- Assessment of the historical and current market size (2017-2021), market projections (2022-2030), and its contribution to the parent market

- Key drivers, restraints, opportunities, and key emerging trends impacting market growth

- Predictions on critical supply, demand, and technological trends and changes in consumer behavior

- Value chain analysis (list of manufacturers, distributors, end-users, average profitability margins, etc.)

- Segment-wise, country-wise, and region-wise market analysis

- Competition mapping, market share analysis, key strategies adopted by top players, and competitive tactical intelligence

- Key product innovations and regulatory framework

- Covid-19 impact on the Market and how to navigate

- Strategic market analysis and recommendations on crucial winning strategies

| Research Scope | Details |

| Forecast period | 2022-2030 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | Application, End-Use, Source, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |