Lead Acid Battery for Energy Storage Market Size Analysis

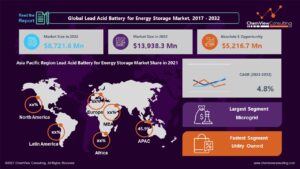

According to a research survey conducted by ChemView Consulting, in 2022, the Global Lead Acid Battery for Energy Storage Market was worth US$ 8,721.6 Mn and is expected to grow at a CAGR of 4.8% over the forecast period. While the historical CAGR is 4.3%, the market is expected to hit US$ 13,938.3 Mn by 2032 end.

The lead acid battery is the most traditional form of rechargeable battery and is used in a wide range of industries. Because the cells have a high power-to-weight ratio, it offers the benefit of delivering a strong surge current. Lead acid batteries are appealing for usage in the automobile industry due to their high power-to-weight ratio and low price. Battery terminals, plates, cells, separators, and containers are the components of lead-acid batteries.

Rapid technical improvements and the rise of the telecom industry are the main drivers fueling the lead acid battery market’s expansion. On the other hand, the availability of inexpensive alternatives in the energy storage sector and safety issues associated with using batteries are recognized as limiting the market’s growth over the projection period.

Market Dynamics

WIDE UTILIZATION OF LEAD ACID BATTERIES DRIVES THE MARKET GROWTH

The need for lead-acid batteries is predicted to rise across several sectors, including automotive, telecom, oil and gas, mining, manufacturing, and chemical. Lead acid batteries provide several benefits over other types of batteries, including affordability, a high current carrying capacity, tolerance to overcharging, and a wide variety of sizes and specifications.

Lead acid batteries may be recycled, and in certain nations, the recycling rate for lead acid batteries is above 90%. Along with saving resources and lowering pollution, this also reduces battery prices. The lead acid battery market is driven by all these benefits and the large range of applications.

AFFORDABLE ALTERNATE OPTIONS HAMPER THE MARKET GROWTH

The technology that has shown to be the most economical is lead acid batteries. However, lead acid batteries are no longer as cost-effective as they once were due to the development of substitute battery storage technologies, particularly lithium-ion technology. Almost all industries are seeing a decrease in the cost of lead-acid batteries. On the other hand, the Nickel-Metal Hydride (NiMH) battery is a tried-and-true technology for hybrid applications.

Manufacturers of original equipment (OEM) like Toyota, Honda, and Lexus employ it. The OEMs prefer these batteries because they are safe, effective, and have a longer lifespan in hybrid applications. Additionally, nickel-cadmium batteries, as well as NiMH batteries, demonstrate to be an affordable option for battery storage consumers. Compared to lead-acid batteries, they are more affordable and efficient.

Market Segments Covered in Report

By Type:

- Utility Owned

- Custom Owned

- Third-Party Owned

By Application:

- Micro Grid

- Household

- Industrial

- Military

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Segment-Wise Analysis

Why is the Lead Acid Battery for Energy Storage microgrids segment projected to have a larger market share?

Following a rise in solar and wind energy installations across many nations, microgrids now have the most installed batteries. These sites store and then transmit the energy produced by solar and wind farms to other areas. In the upcoming years, government support and funding for solar and wind installations are anticipated to increase significantly, further fueling the microgrid segment’s growth.

Why are utility-owned companies expected to expand the fastest during the forecast period?

To fulfill the power demand and promote the development of new technologies, utility providers complete most battery installations. Several new technologies, like DEG and VPP, need battery installation by utility companies to save extra energy from houses and power plants.

Region-Wise Analysis

The regions analyzed for the market include North America, Europe, Latin America, Asia Pacific, Middle East, and Africa.

- From 2022 to 2032, Asia Pacific is anticipated to have the biggest market. In 2021, Asia Pacific had a market share of 45.9%. Cost-effective battery storage solutions are becoming necessary due to the rising demand for peak shaving, backup power, grid stability, and renewable energy integration with the primary grid. It drives the market for lead-acid batteries in the area.

- The market for lead acid batteries in North America is the second-largest. The rising government emphasizes cutting greenhouse gas emissions, the frequency of power disruptions, and increasing technological advancements. Additionally, the region’s established infrastructure fosters market expansion and facilitates the quicker adoption of cutting-edge technology. Another significant element propelling the growth of the lead acid battery market in the area is the expanding number of manufacturers offering lead-acid batteries at comparably reduced prices.

Competition Analysis

The lead acid battery market looks extremely competitive and fragmented, with both large and small competitors present. To get a greater portion of the lead acid battery industry, the corporations implemented growth methods such as contracts and agreements, investments and expansions, partnerships, collaborations, alliances, and joint ventures.

Some of the key developments that have taken place in the Lead Acid Battery for Energy Storage Market include:

- In December 2021, Tata AutoComp GY Batteries Limited, an equity-method associate of subsidiary GS Yuasa International Ltd., announced intentions to boost its annual manufacturing capacity for motorcycle lead-acid batteries to 8.4 million units, according to GS Yuasa Corporation. Its market share in India is to be increased.

- In January 2022, The technological minerals-owned firm Recycles Group Ltd. built a new facility in Tipton, England, to recycle lead-acid batteries.

A list of some of the key suppliers present in the market are:

- ATLASBX Co. Ltd.

- Johnson Controls

- Exide Technologies

- NorthStar

- East Penn Manufacturing Co.

- Crown Battery Manufacturing

- GS Yuasa Corp

- C&D Technologies Inc.

- Leoch International Technology Ltd.

- Narada Power Source Co. Ltd.

Global Lead Acid Battery for Energy Storage Market 2022-2032: Report Coverage and Highlights

- Assessment of the historical and current market size (2017-2021), market projections (2022-2032), and its contribution to the parent market

- Key drivers, restraints, opportunities, and key emerging trends impacting market growth

- Predictions on critical supply, demand, and technological trends and changes in consumer behavior

- Value chain analysis (list of manufacturers, distributors, end-users, average profitability margins, etc.)

- Segment-wise, country-wise, and region-wise market analysis

- Competition mapping, market share analysis, key strategies adopted by top players, and competitive tactical intelligence

- Key product innovations and regulatory framework

- Covid-19 impact on the market and how to navigate

- Strategic market analysis and recommendations on crucial winning strategies

| Research Scope | Details |

| Forecast period | 2022-2032 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Tons for Volume, and CAGR from 2022 to 2032 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Type, Application, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |