Lysine Market Size Analysis

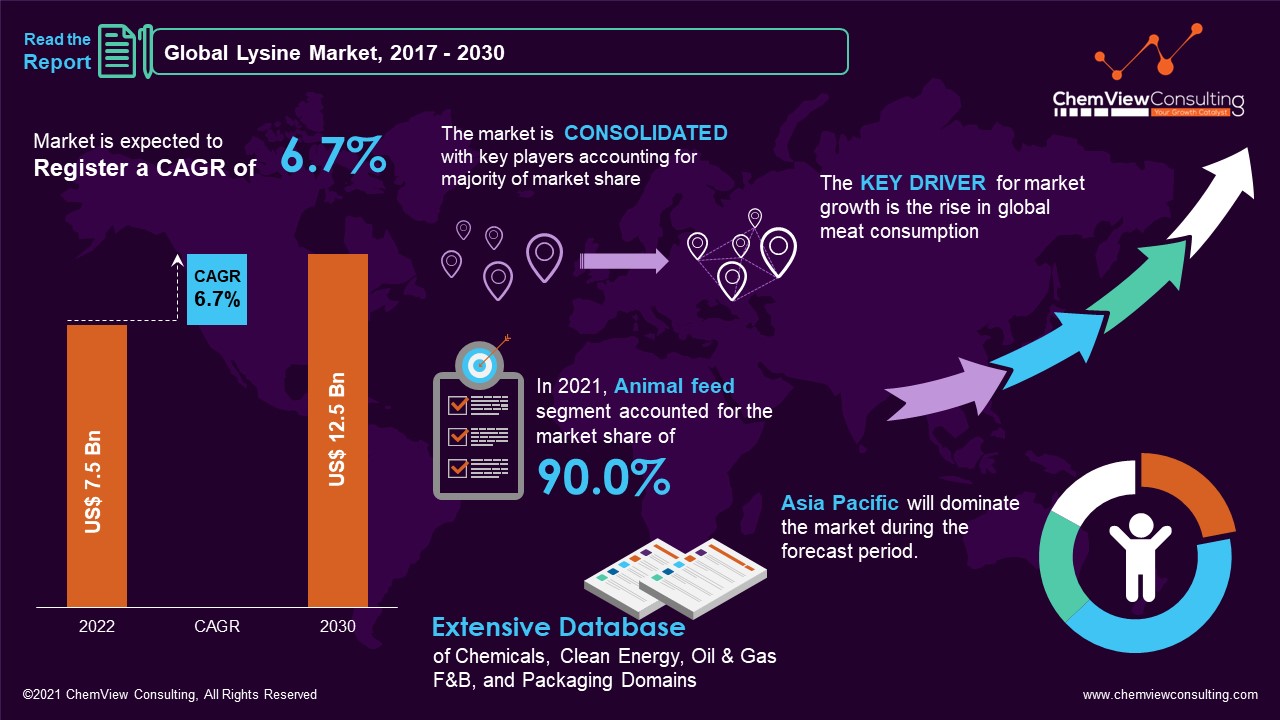

According to a research survey conducted by ChemView Consulting, in 2022, the Global Lysine Market was worth US$ 7.5 Bn and is expected to grow at a CAGR of 6.7% over the forecast period. The market is expected to hit US$ 12.5 Bn by 2030 end.

Lysine is an amino acid that both humans and animals require. Human/animal bodies, on the other hand, are unable to produce lysine naturally, which is projected to boost product demand. It is necessary for monogastric organisms to grow and develop properly.

Feed premixing is critical for optimizing feed additives and feed characteristics. Feed Premix also helps animals by improving their immunological and reproductive systems and enhancing their metabolism. A “premix” is a compound that contains vitamins, trace minerals, antibiotics, feed supplements, and diluents.

Market Dynamic

What are the causes driving the rise in demand for lysine?

Demand for lysine in the animal feed sector will be driven by an increase in worldwide meat consumption, particularly in emerging nations, as well as a growing population and rising affluence. Animal feed will be necessary to satisfy these requirements due to the rapid development of animals. Lysine contributes to this by allowing animals to gain weight quicker by extracting nutrients from a limited diet while still delivering excellent meat.

Lysine is a cost-effective and efficient substitute for expensive feeds for both farmers and animals, and it has fewer environmental consequences due to nitrogen excretion.

A rise in global meat consumption, particularly in emerging markets, as well as a growing population and increased prosperity, will stimulate demand for lysine in the animal feed business. Animal feed will be required to satisfy these requirements so that animals can develop swiftly. It is supported by lysine, which allows animals to gain weight more quickly while still producing high-quality meat by absorbing nutrients from limited nutrition.

What opportunities exist in the Lysine Market?

Global meat consumption, particularly in developing countries. It will be accompanied by a growing population and an increase in wealth. H will drvе dеmаnd fоr lуnе n аnmаl fееd.

The global market has expanded because of rising food prices and many countries’ elimination of bone and blood meals.

What are the primary problems that the Lysine Market faces?

Tight feedstock supply is predicted to affect demand, causing prices to rise, and government intervention is possible, reducing market participants’ profitability. This condition may also prompt examination of different amino acid feed choices, such as tryptophan, methionine, and threonine. The drop in meat consumption caused by outbreaks like avian flu and swine flu might impact lysine demand in the slow feed market.

Segment-Wise Analysis

Which application segment is predicted to expand the quickest in terms of CAGR?

Animal feed became lysine’s most important use sector, accounting for 90.0% of total volume in 2021. Animal feed has emerged as the most important use area for lysine. Over the projected period, the category is also predicted to be the fastest-growing application segment. It is due to the cheap cost and efficient replacement of lysine for more expensive crude proteins such as soybean and maize.

Why is the swine/hog segment expected to increase fast throughout the projection?

In 2021, the swine/hog category accounted for approximately 59.0% of the total volume. Furthermore, the market is predicted to be the fastest-growing livestock segment for lysine throughout the projection period, with a CAGR of 6.5%. Growing demand for pork meat, particularly in China, is likely to drive category expansion.

Which region has promising opportunities in the global Lysine market?

Asia is the most important consumer and producer market for pork, accounting for roughly half of global output. Due to the high consumption of pork meat, the Global region is the largest market for lysine products.

The Asia Pacific is the world’s largest producer and exporter of pork. Pork meat has been consumed in the area since ancient times and is the most popular meat due to its high-fat content and flavor. China is the most important market for pork producers, followed by Vietnam, Thailand, South Korea, Japan, and the Philippines.

Competition Analysis

Companies in the field service a wide range of end-use sectors, including animal feed, food and dairy, and medicines. Few of these businesses have a tightly knit supply chain that allows them to access a larger client base. They ensure an established network of suppliers and distributors with a good reputation and high regional presence to cater to the niche markets.

Some of the key developments that have taken place in the Lysine Market include:

- In October 2021, Cargill and BASF established an animal nutrition cooperation that would expand the companies’ current feed enzymes distribution agreements by adding research and development capabilities and new markets. This collaboration contributed to the research, manufacture, marketing, and sale of customer-focused enzyme products and solutions for animals, especially pigs.

- In July 2021, De Heus purchased Coppens Diervoeding, a Dutch feed production firm specializing in pig farming. As a result of this transaction, the company’s regional footprint increased by 400k.

A list of some of the key suppliers present in the market are:

- Cargill, Incorporated

- Dow

- BASF SE

- Hansen Holding A/S

- DSM

- DuPont

- Evonik Industries AG

- Novus International

- Alltech

- Associated British Foods plc

- Charoen Pokphand Foods PCL

- Nutreco

- De Heus Animal Nutrition

- Land O’Lakes

- Kent Nutrition Group

- D. Heiskell & CO

- Perdue Farms

- SunOpta

- Scratch Peck Feeds

Market Segments Covered in Report

By Application:

- Animal Feed

- Food & Dietary Supplements

- Pharmaceuticals

By Livestock:

- Swine/hog

- Poultry

- Others (aquaculture, cattle)

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Global Lysine Market 2022-2030: Report Coverage and Highlights

- Assessment of the historical and current market size (2017-2021), market projections (2022-2030), and its contribution to the parent market

- Key drivers, restraints, opportunities, and key emerging trends impacting market growth

- Predictions on critical supply, demand, and technological trends and changes in consumer behavior

- Value chain analysis (list of manufacturers, distributors, end-users, average profitability margins, etc.)

- Segment-wise, country-wise, and region-wise market analysis

- Competition mapping, market share analysis, key strategies adopted by top players, and competitive tactical intelligence

- Key product innovations and regulatory framework

- Covid-19 impact on the market and how to navigate

- Strategic market analysis and recommendations on crucial winning strategies

| Research Scope | Details |

| Forecast period | 2022-2030 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Billion for Value and Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Application, Livestock, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |