Polysulfone Market Size Analysis

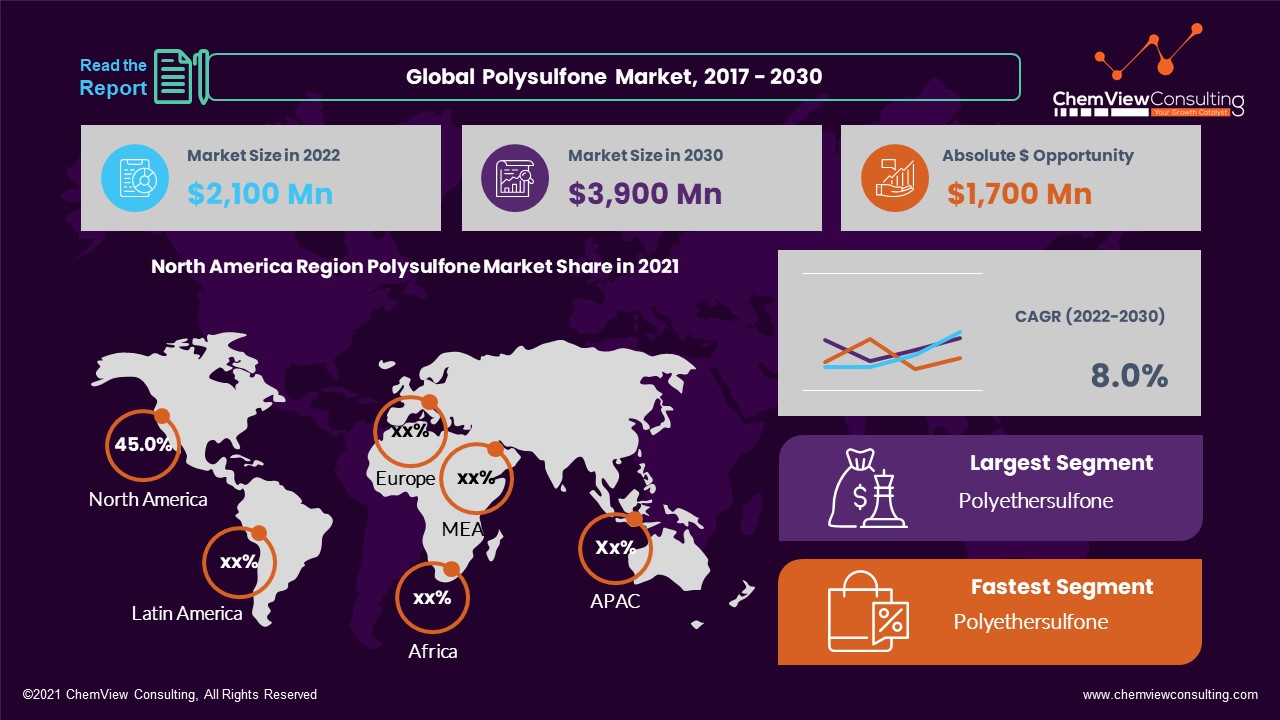

According to a research survey conducted by ChemView Consulting, in 2022, the Global Polysulfone Market was worth US$ 2,100 Mn and is expected to grow at a CAGR of 8.0% over the forecast period. The market is expected to hit US$ 3,900 Mn by 2030 end.

The growing demand for high-performance thermoplastics from different end-use sectors, such as medical devices, automotive, electrical & electronics, aerospace, and others, propels the polysulfone market forward. Polysulfones are amorphous thermoplastics with phenyl and biphenyl groups connected by ether and sulfone that are thermally stable.

Market Dynamic

NUMEROUS APPLICATIONS OF POLYSULFONE DRIVE THE MARKET GROWTH

The polysulfone market is quickly expanding due to its numerous uses in the food and beverage, automotive, electronics, and electrical industries. Polysulfones are used in coffee makers, juice mixers, and grinders. Polysulfone is used as a mixer in automobiles to make vehicle headlights. It is also utilized in the electronics and electrical industries to make refrigerator parts, LED components, washing machine parts, and many other things.

The polysulfone market is opportunistic due to its application versatility compared to other engineering polymers. Demand from the medical device, automotive, and electrical and electronics sectors are driving the expansion of the polysulfone market.

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the worldwide polysulfone market. The vehicle industry is one of the largest purchasers of polysulfone. The pandemic has had an immediate and severe impact on the worldwide automobile industry, significantly reducing polysulfone demand.

The worldwide economic downturn induced by the pandemic has reduced demand for electrical equipment in the vehicle, construction, and medical industries. As a result, demand for polysulfone in the electrical equipment industry has decreased.

Market Segments Covered in Report

By Type:

- Polysulfone

- Polyethersulfone

- Polyphenylsulfone

By Application:

- Medical Devices

- Automotive

- Electrical & Electronics

- Aerospace

- Others (Defence, Household products, etc.)

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Segment-Wise Analysis

Why are Polyethersulfone Type Polysulfone projected to have the highest CAGR?

Polyethersulfone emerged as the most important product segment, with a market share of more than 55.0%. Because of its exceptional qualities such as transparency, minimal smoke generation, remarkable electrical capabilities at severe temperatures, and good chemical resistance, Polyethersulfone is extensively used in safety face shields, printed circuits, connectors, and high-intensity light bases, and machine guards.

Why is it predicted that Polyphenylsulfone Type Polysulfone would have the fastest CAGR?

Because Polyphenylsulfone can be readily sterilized by high-temperature steam without losing any features, the product has the potential to see rising demand in medical devices and dentistry equipment at the highest growth rate. Polyphenylsulfone is widely utilized in the aerospace sector for airplane interiors.

Which application type is driving the growth of the Polysulfone market?

The market is driven due to the high growth in the global medical and automotive industry. Healthcare alone is expected to hold a market share of 32.0% during the forecast period.

One of the primary variables driving market expansion is the increase in demand for polysulfone in the global pharmaceutical industry. Polysulfone is a high-performance plastic with high permeability, strength, and resistance to infections; as a result, it is used to make some parts of X-ray machines, CT scan machines, and M.R.I. machines.

Region-Wise Analysis

The regions analyzed for the market include North America, Europe, Latin America, Asia Pacific, Middle East, and Africa.

- North America and Europe dominate the worldwide polysulfone market. North America had more than 0% of the total market size in value and consumption in 2021. Rising technical developments in the medical industry and increasing automotive industry in the United States and Germany are driving the polysulfone market in North America and Europe.

- The Asia Pacific polysulfone market is predicted to rise rapidly during the forecast period, owing to the expansion of end-user industries such as food and beverage, building and construction, and automotive in rising nations such as China, India, Vietnam, and Indonesia.

Competition Analysis

Over the last few years, many market actors have been actively interested in mergers and acquisitions. Key firms aim to expand their regional footprint, particularly in unorganized countries like India, Brazil, and China, highlighting the distribution channel’s importance in this industry.

Some of the key developments that have taken place in the Polysulfone Market include:

- In December 2021, Toray Industries, Inc. announced the development of the FILTRYZER HDF, Japan’s first PMMA hollow fiber membrane-based hemodiafiltration device. Toray Medical Co., Ltd., a wholly-owned subsidiary, will commence marketing.

A list of some of the key suppliers present in the market are:

- BASF SE

- Solvay Chemical Company

- SABIC Innovative plastics

- Ensigner Inc.

- Sumitomo Chemicals

- Quadrant Engineering Plastics Product

- NYTEF Plastics Ltd.

- Polymer Dynamix

- Westlake Plastics Company

Global Polysulfone Market 2022-2030: Report Coverage and Highlights

- Assessment of the historical and current market size (2017-2021), market projections (2022-2030), and its contribution to the parent market

- Key drivers, restraints, opportunities, and key emerging trends impacting market growth

- Predictions on critical supply, demand, and technological trends and changes in consumer behavior

- Value chain analysis (list of manufacturers, distributors, end-users, average profitability margins, etc.)

- Segment-wise, country-wise, and region-wise market analysis

- Competition mapping, market share analysis, key strategies adopted by top players, and competitive tactical intelligence

- Key product innovations and regulatory framework

- Covid-19 impact on the market and how to navigate

- Strategic market analysis and recommendations on crucial winning strategies

| Research Scope | Details |

| Forecast period | 2022-2030 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Million for Value and Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Type, Application, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |