Sugar Alcohol Market Size Analysis

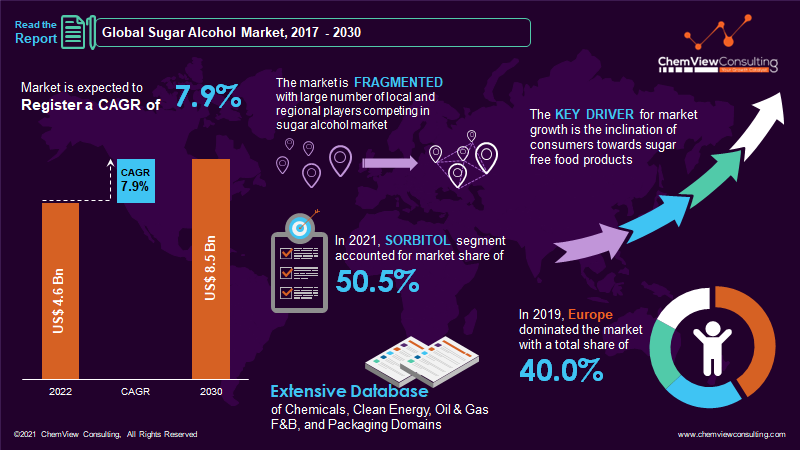

According to a research survey conducted by ChemView Consulting, in 2022, the Global Sugar Alcohol Market was worth US$ 4.6 Bn and is expected to grow at a CAGR of 7.9% over the forecast period. The market is expected to hit US$ 8.5 Bn by 2030 end.

Sugar alcohols are a family of polyols that are chemical molecules generated from sugars. They are white, water-soluble solids that can exist naturally or be synthesized artificially from sugars.

Consumers are choosing healthier options, which has increased the demand for nutritive sweeteners such as sugar alcohols, which also have a lower blood glucose response.

Market Dynamic

What are the causes driving the rise in demand for Sugar Alcohol?

Consumer concern about the health effects of artificial sugar substitutes has increased the demand for sustainable and low-calorie alternative sweeteners. Sugar alcohols created from biomass have a wide range of applications, including oral hygiene, pharmaceutical sectors, and food containing sugar alcohols; as a result, these goods are becoming more common on supermarket shelves. Expanding sugar alcohol applications across sectors also drives the sugar alcohol market.

Sugar alcohol’s usefulness in increasing diabetes metabolism without the need for insulin has increased its popularity in the food and beverage industry. Sugar alcohols are considered natural chemicals and acceptable food additives due to their low level of digestible carbs.

What are the opportunities in the Sugar Alcohol Market?

The industry will gain traction during the forecast period due to increased consumer consumption of nutraceuticals in functional foods, dietary supplements, and beverages. Polyols are employed in various pharmaceutical and nutraceutical products due to their coating, sweetening, emollient, bulking, anti-crystallizing, and stabilizing qualities. As a result, increased use of sugar alcohols in pharmaceutical manufacturing will drive sugar alcohol market growth and positively impact sugar alcohol market demand.

What are the major challenges confronting the Sugar Alcohol Market?

The manufacturing of sugar alcohols is far more complicated than that of artificial sweeteners. Several firms are having difficulties obtaining raw materials, developing cost-effective manufacturing procedures, and reducing the emission of volatile byproducts. The high manufacturing costs of sugar alcohol compared to sugar will likely hinder the sugar alcohol market’s expansion.

COVID-19 Impact

The coronavirus outbreak has substantially influenced numerous food and beverage businesses and all stages of various industries’ supply chains and value chains. It has impacted the supply chain ecosystem, including raw material suppliers, logistical partners, and others. As a result, the COVID-19 pandemic had a limited influence on the sugar alcohol sector.

Segment-Wise Analysis

Why is the Sorbitol Sugar Alcohol type expected to grow at the fastest CAGR?

The sorbitol segment had 50.5% of the global market in 2019. Sorbitol has texturing qualities as well as sweetening properties. It is a great humectant, softener, texturizing, and anti-crystallizing agent and so has several applications in the food and beverage, pharmaceutical, and cosmetic sectors.

Sorbitol is still one of the most popular items on the sugar alcohol market. It is often used in low-calorie foods and beverages such as dairy products, confectionery, etc.

Sorbitol’s expanding use as a sugar derivative in beverage production has contributed to its rising sales in the worldwide sugar alcohol industry. According to the analysis, the global market for sugar alcohols would generate more than US$ 550.5 million from sorbitol sales by the end of 2030.

Why is Food & Beverage segment likely to grow the most rapidly throughout the forecast period?

The food and beverage industry dominated the sugar alcohol market, accounting for 40.5% of the total market value. Sugar alcohols are mostly used in manufacturing food and beverage goods due to their sweetness and texturing capabilities.

Recent technological advancements have broadened the range of sugar alcohols available for culinary use, resulting in increased applications of these sugar substitutes in diet and health-oriented meals. The increasing demand for sugar alcohols among food and beverage firms is expected to generate more than $1000 Million in global revenue. Sugar alcohols will be widely employed in the production of drinks, dairy products, and bread goods over the forecast period.

Why is the Bakery segment likely to grow rapidly throughout the forecast period?

Sugar alcohols are widely utilized in baking and confectionery. Applications such as sugar substitutes used as humectants, texturizers, and moisture retainers are projected to have a long-term positive impact on the industry, particularly for customers seeking healthier components in various end product offerings.

Which form segment will likely grow the most rapidly throughout the forecast period?

The powder & crystal segment dominated in 2019, accounting for 61.5% of the sugar alcohol market. Sugar alcohol in powder and crystal form has a longer shelf life and is easier to handle, transport, and store. As a result, it is commonly used to produce various food products, including sweets, chewing gum, and baked goods.

Why is the Europe region cementing its global dominance in the Sugar Alcohol Market?

Europe is a major, fast-growing market for sugar alcohol. High sales for confectionery products, increased consumer awareness about sugar alternatives, and sugar-free formulations of processed foods and beverages in the region, especially among urban populations, will support long-term growth.

In 2019, Europe dominated the sugar alcohol market, accounting for 40.0% of the total market share. It is ascribed to the region’s remarkable popularity and large consumption of low-calorie food and beverages.

Competition Analysis

To compete in a fragmented, competitive environment, key players have largely invested in expanding production capacities and R&D to expand product portfolios with nutritious, low-calorie offerings in compliance with regulatory standards for various applications, including food and pharmaceuticals, for long-term growth.

Some of the key developments that have taken place in the Sugar Alcohol Market include:

- In November 2020, Roquette, a plant ingredient firm headquartered in France, announced the launch of a soft gel capsule formulation known as sLycagel. The new formula contains NEOSORB Sorbital and carrageen. The product improves capsule strength and processing temperature compatibility.

- In May 2020, Ingredion EMEA, a starch syrup and sugar manufacturer based in the United States, introduced its first sugar alcohol sweetener to the market. The “ERYSTA Erythritol” product can be used to make a low-calorie product. The food is produced through fermentation and contains no calories.

A list of some of the critical suppliers present in the market are:

- Tate & Lyle Plc.

- Archer Daniels Midland Company

- DuPont

- Cargill, Inc.

- BENEO GmbH

- Roquette Freres

- Ingredion Incorporated

- Beckmann Kenko GmbH

- Mitsubishi Shoji Foodtech Co. Ltd.

- Fraken Biochem Co. Ltd.

- A&Z Food Additives Co. Ltd.

- SPI Pharma

- Lonza Group

- Atlantic Chemicals Trading GmbH

Market Segments Covered in Report

By Product Type:

- Sorbitol

- Xylitol

- Maltitol

- Lactitol

- Erythritol

- Isomalt

- Mannitol

- Others

By Form:

- Powder & Crystal

- Liquid & Syrup

By End-User:

- Food & Beverages

- Pharmaceuticals

- Others

By Application:

- Bakery Goods

- Sweet Spreads

- Confectionery & Chewing Gum

- Beverages

- Dairy Products

- Others

By Region and Country:

- North America (U.S., Canada)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Europe (Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, Rest of Europe)

- Asia-Pacific (China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Rest of Asia-Pacific)

- Middle East (Saudi Arabia, Turkey, UAE, Rest of Middle East)

- Africa (South Africa, Nigeria, Egypt, Rest of Africa)

Global Sugar Alcohol Market 2022-2030: Report Coverage and Highlights

- Assessment of the historical and current market size (2017-2021), market projections (2022-2030), and its contribution to the parent market

- Key drivers, restraints, opportunities, and key emerging trends impacting market growth

- Predictions on critical supply, demand, and technological trends and changes in consumer behavior

- Value chain analysis (list of manufacturers, distributors, end-users, average profitability margins, etc.)

- Segment-wise, country-wise, and region-wise market analysis

- Competition mapping, market share analysis, key strategies adopted by top players, and competitive tactical intelligence

- Key product innovations and regulatory framework

- Covid-19 impact on the market and how to navigate

- Strategic market analysis and recommendations on crucial winning strategies

| Research Scope | Details |

| Forecast period | 2022-2030 |

| Historical data available for | 2017-2021 |

| Market analysis | USD Billion for Value and Tons for Volume, and CAGR from 2022 to 2030 |

| Key regions covered | North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa |

| Key countries covered | US, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, Netherlands, Norway, Russia, China, Japan, South Korea, India, Indonesia, Thailand, Vietnam, Australia & New Zealand, Saudi Arabia, Turkey, UAE, South Africa, Nigeria, Egypt |

| Key segments covered | By Product Type, Form, Application, End-User, and Region |

| Customization scope | Available upon Request |

| Pricing and purchase options | Available upon Request |